Description

The Bureau implemented the Tax Computerization Program (TCP) in 1994 to establish an integrated tax system designed to provide a standard processing framework for the Bureau's functions related to tax collection and administration.

Having an integrated tax system supports the Bureau in meeting its goals in increasing revenue collections, improving taxpayer service, promoting better taxpayer compliance, and improving operational efficiency and transparency.

[back to top]Benefits From The Tax Computerization Program

· Increased revenue collection through strengthened collection efforts, improved collection programs and enabled collection officers

· Improved taxpayer service through time efficient taxpayer transaction processing, including responding to queries and completion of taxpayer-related services

· Improved taxpayer compliance with automated audit selection case management, income verification and withholding tax reconciliation

· Improved processes with better provision of management information, and reduction of turnaround times to complete activities

· Increased technology literacy of BIR management and personnel based on new and improved processes

· Established information linkages with affiliations with other government agencies, as well as private institutions like banks and insurance companies

Integrated Tax System (ITS)

The core of the BIR TCP is the Integrated Tax System or ITS. ITS is a set of related systems and processes, which run and facilitate the Bureau's core business functions. It provides maximum automation and minimum manual intervention in BIR operations. ITS supports the Bureau in servicing taxpayers on different aspects of the tax collection and administration process.

With fourteen (14) application systems in place, ITS allows the Bureau to approach all of its information and major business functions in a consolidated manner. Said application systems can be classified into the following:

· tax systems for Revenue District Offices to support taxpayer transactions, tax collection accounting, tax compliance and management and decision support;

· tax systems for the National Office to facilitate decision making and enhance the flow of vital information needed by management in tax planning, policy analysis and projections;

· tax system for authorized agents banks (i.e. Limited Bank Data Entry) to record and electronically transmit payment data from taxpayers.

As of today, benefits of the ITS are being realized in the areas of revenue collections, taxpayer compliance, taxpayer service and information linkages among others.

Full ITS Rollout Acceleration Program

Objective

To implement an integrated tax system that is information-driven and consistent with impartial tax compliance enforcement capabilities, that will eventually: strengthen revenue generation; improve capacity to profile taxpayer; enable compliance improvement; and improve operational efficiency.Scope and Time Table

The full ITS Rollout Acceleration Program includes the implementation of the existing back-end systems in various release stages at various target sites and completion dates.

Release 1: Accounts Receivable Capability

Description

The Accounts Receivable Capability provides timely identification and efficient monitoring of the status of all receivable accounts, as well as a facility to set up, maintain and inquire on installment payment arrangements granted to the taxpayers in the settlement of his deficiency.

Objectives

· To increase revenue collection through:

- Automatic identification and efficient monitoring of all receivable accounts

- Standardized and systematic collection procedures

· To enhance taxpayer compliance through:

- Timely issuance of reminder letters

- Systematic pursuance of A/R cases thru the A/R case template

· To increase customer satisfaction through:

- Prompt response to taxpayer inquiries

Impact

· On technology

- A/R cases may be created and closed automatically

- Documentation of A/R cases will be computer-aided

- A/R reports and correspondences will be generated automatically

- Review of and inquiry on A/R cases will be possible even in the absence of assigned Revenue Officer

· On process

- Identification of A/R cases will be automated and will be performed at the RDC

- Set-up, maintenance and inquiry on installment plans will be done on-line

- Follow-up steps for A/R cases will be systematized through the use of A/R case templates

· On people

- Case officers will be assigned to do on-line documentation, monitoring, and maintenance of A/R cases

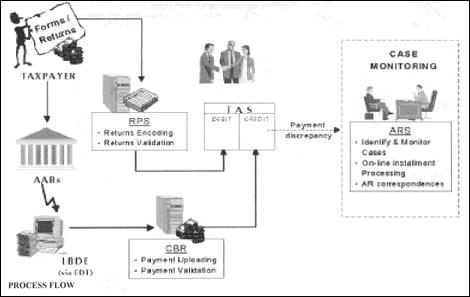

Process Flow

Release 2. AUD -Taxpayer Profiling Using NOMIS

Description

The Taxpayer Profiling using NOMIS Process enables the detection of non-registrants and use of invalid TINs, as well as ensures comprehensive processing of specific taxpayer/tax type, and donors and estate taxes by maximizing the use of external (third party) information and internal (ITS) information.

Benefits

· Strengthen revenue generation

- Identification and notification of potential non-registrants to increase taxpayer base

· Improve capacity to profile taxpayers

- Automated interfaces to facilitate data sharing internally and with external agencies (e.g. BOC, LRA, SEC)

- Online availability of taxpayer's external information

· Enable compliance improvement

- Timely issuance of correspondences, audit and assessment notices

· Improve operational efficiency

- Timely and accurate processing of third party information

- Availability of monthly audit accomplishment reports

Impact

· On Technology

- Generated notices can be reviewed on-line

- Assignment of assessment cases to case officers will be computer-aided

- New job definitions will enable automatic generation and printing of correspondences, audit and assessment notices

- Uploading of third party information

· On Processes

- Detection of non-registrants and invalid TIN users will be ITS-aided

- Generation of list of individuals/non-individuals with valid and invalid TIN and potential non-registrants will be periodic

- Taxpayers external profile will be available on request

- Third party information from external agencies will be uploaded weekly

· On People

- Group Supervisor will assign case to Case Officer through the Case Monitoring System (CMS)

- Case Officers will update status of case and prepare reports for possible tax evasion on-line

- RDC-CONE will run batch programs essential for matching third party information

- The Chief of the Audit Information, Tax Exemption and Incentives Division will now assign cases to respective RDO's instead of the ROC System Administrator

Process Outputs

· Assessment notice issuance for taxpayer audit

· TCL issuance for donors/estate tax payment

Process Flow

Release 3. TCR- Issuance of Tax Credit Certificate/ Tax Debit Memo

Description

The Tax Credit Certificate (TCC)/Tax Debit Memo (TDM) Issuance Capability will enable the BIR to facilitate the processing of tax credits by automatically initiating tax credits for overpayments or manual application.

Release 4. Centralized Issuance of Tax Debit Memo

Description

The centralized issuance of Tax Debit Memo (TDM) at the Collection Programs Division (CPD) enables the Bureau to maintain a comprehensive inventory of TDMs issued, as well as the automated printing of TDM at the National Office level.

Expected Benefits

· Reduction in personnel requirement through automatic generation of Tax Debit Memo (TDM)

· Enhancement in the monitoring of TDM issuance backlog

· Faster processing of claims for TDM

Release 5. Executive Information System (EIS) - Management Reporting Capability

Description

The EIS Management Reporting Capability utilizes consolidated statistical data coming from various sources (external and internal). The information is meant to aid management in tax planning, policy analysis and projections.

Expected Benefits

· Will provide timely access to data and information for improved management decision-making

· Will enhance the flow of vital information needed by BIR management in tax planning, policy analysis and projections

· Will provide wide range of automated interfaces that will facilitate data sharing within the BIR and with external agencies

· Will enhance the Bureau's report generation capability and reduce report generation processing cost

Reports That Could Be Generated

· Cumulative Collection vs. Goal Region

· Collections vs. Goal by Month

· Collection by Type of Tax as of a given Month

· Collections vs. Goal by Year

· Collection by Type of Tax for a Given Year

· Outstanding Accounts Receivable Analysis

· Collections by Collection Agents

· Distribution by Taxpayers

· Tax Credit Statistics

· Overall RDO ranking-based on Collection Goals

· Statistics on Registered Taxpayers

· Statistics on Exemption Type

· Statistics on Excise Tax

Release 6. TRS- Withholding Tax Income Verification

Description

The TRS -Withholding Tax Income Verification Capability aims to detect proper remittance and declaration of taxes by matching income sources utilizing taxpayer and withholding agent data.

Expected Benefits

· Correct declaration of income and withholding tax remitted

· Detection of fictitious claims of withholding tax credit claims

· Increase in the number of fully compliant withholding agents

· Early identification of erring withholding agents and taxpayers resulting to increase in the number of productive TRS cases

· Decrease in the number of discrepancy cases

· Ability to monitor performance of Case Officers assigned TRS cases

Release 7. TCR-Issuance of Tax Refunds

Description

The Issuance of Refunds Capability enables the Bureau to facilitate the processing of refunds by automatically initiating tax refunds for overpayments or through manual application by taxpayer. This system involves three (3) interrelated processes: Refunds Identification, Refunds Approval and Refunds Issuance.

Expected Benefits

· Single point inquiry

· Better monitoring of refunds statistics

· Facilitate tax refund reconciliation